Australia faces a revenue black hole as economy slows

- Published

Budget night in Canberra is the closest Australia comes to a Washington-style State of the Union address.

The Treasurer's report on the state of the nation's finances is one of only two speeches during the parliamentary year broadcast live in prime-time - the other is the opposition leader's response two nights later.

In a rural capital hardly renowned for its nightlife, it is also one of the few occasions when there is a definite charge in the air.

For reporters in the Canberra press gallery, there is also a sense of liberation.

During the hours leading up to the Treasurer's speech, they are kept in lock-down in a room in Parliament House, so that they can study what is about to be said but not report the details until after he steps before the House of Representatives.

Over the past two decades, successive Treasurers have generally enjoyed their moments in the limelight.

After all, the Australian economy has enjoyed 21 straight years of uninterrupted annual growth.

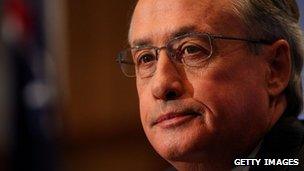

Twelve months ago, Wayne Swan was basking in that success: "The four years of surpluses I announce tonight are a powerful endorsement of the strength of our economy, resilience of our people, and the success of our policies."

'A sledgehammer to revenues'

Now, as he prepares to deliver what is likely to be his final budget - his "Swan song" it will doubtless be called - the mood is wholly different.

For he could be looking at what economists are calling a decade of debt.

Having pledged repeatedly to return the budget to surplus, Mr Swan has admitted in the lead-up that the country now faces a budget black hole.

Rather than deliver the bad news in one go on budget night, which would have spooked the markets, he has spent the last month preparing the ground.

The Treasurer started by initially revealing a 7.5bn Australian dollar (£4.9bn; $7.5bn) hole - what he called "a sledgehammer to revenues in the budget."

Two weeks ago, it rose to A$12bn. Then, just a week later the official figure reached A$17bn.

Small wonder that the country's shadow treasurer, Joe Hockey, exclaimed: "What the hell is happening in Canberra!"

"Where are all these billions going in a matter of days?"

Rising Australian dollar

During the mining boom, which began ten years go, successive governments made long-term spending commitments that are now hard to fund, because of the fall in commodity prices and revenues from corporate taxes.

The government's mining tax, which was intended to spread the vast riches of the resources boom, has ended up being what the veteran political commentator Michelle Grattan has called, "a nearly dry well."

Making matters worse for the overall economic outlook, Australia's terms of trade have declined, but the Australian dollar has remained at high levels.

Between June 2012 and April 2013, the currency rose nearly 9% against the US dollar.

Recently, Holden, which is the Australian subsidiary of General Motors, cited the strong Australian dollar as the reason for cutting 12% of its workforce.

Earlier this month, amid growing concerns about an economic slowdown and an end to the mining boom, the Reserve Bank of Australia cut interest rates by 25 basis points to 2.75%. That is the lowest level in 53 years.

The government also needs to fund an ambitious National Disability Insurance Scheme (NDIS) and education reforms.

However, rather than raise income taxes to pay for the NDIS, Canberra is proposing an increase in the levy which taxpayers already pay for health coverage.

It is also abandoning a A$1.8bn family tax benefit, a policy it trumpeted at last year's budget as "spreading the benefits of the boom."

Few giveaways

The cut in interest rates gives mortgage payers relief. But as Michelle Grattan noted: "The Reserve Bank giveth, the government taketh away."

With an election looming in September, which the Labor government is expected to lose heavily, this will be an intensely political budget.

But given there is no money, there is little likelihood of any vote-winning giveaways.

Rather than sweeteners, Denis Atkins of the Brisbane Courier Mail has observed: "You get the feeling we're in for a cold pizza and flat beer budget."

- Published11 February 2013

- Published8 February 2013

- Published30 January 2013

- Published5 December 2012