Q&A: The Anglo Irish Bank trial

- Published

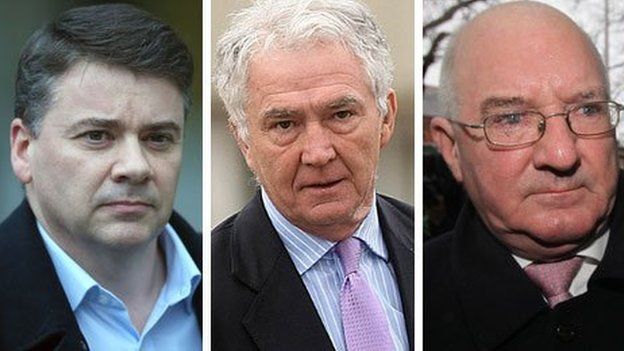

Three former directors of the failed Anglo Irish Bank are awaiting to hear their fate after a Dublin jury began considering its verdict in the men's trial, in which they are accused of illegally supporting the bank's share price.

Who is on trial?

Sean FitzPatrick, Anglo's former chairman and chief executive; Willie McAteer, the bank's former finance director and Pat Whelan who ran the Irish lending division.

No, they are charged in connection with one specific transaction that took place more than six months before the failure of the bank.

It concerns Ireland's former richest man, the County Fermanagh businessman, Séan Quinn.

By the middle of 2008 Mr Quinn was a major problem for the bank. He had made a complicated bet that meant he in effect controlled around 25% of the bank's shares.

But the Quinn bet had gone horrendously wrong. He was sitting on huge - and growing losses - and had reached the point where he needed to end the bet and crystallise the loss.

This raised the prospect that he would have to dump a very large number of shares on the market, which would cause the bank's share price to collapse.

Initially they tried to get international investors to buy the Quinn stake. When that failed they put together a deal involving 10 of the bank's loyal customers - who are known as the Golden Circle or the Maple Ten.

They did - but it did not involve putting up their own money. The bank lent them the necessary funds on very favourable terms.

The bankers were charged under section 60 of the Republic of Ireland's Companies Act, which forbids a firm to lend to a customer with the intention of affecting its own share price. This is illegal because it misleads other investors about the true financial health of the firm.

They do not deny that the loans were made but point to a provision in the law that says a firm can make a loan for share purchases if it is "the ordinary course of business".

As the bank was in the business of lending they say the arrangement was legal. The prosecution argue the deal was far from ordinary.

Far from it. The Irish Financial Regulator knew all about it, the bank was advised by a leading Dublin law firm and the transaction was executed by the investment bank Morgan Stanley.

Anglo's then chief executive, David Drumm, was also deeply involved but he is not on trial, having gone to live in the US where the Irish criminal justice system has not been able to catch up with him.

- Published11 April 2014

- Published18 March 2010