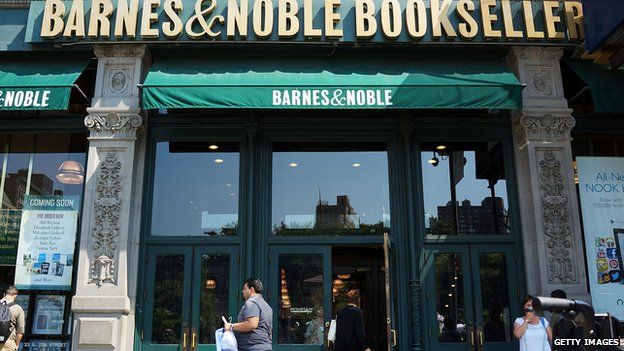

Barnes & Noble chairman trims stake to 20% by selling shares

- Published

Barnes & Noble's chairman has trimmed his stake in the bookstore to 20%, by selling shares worth $64m (£38m).

Leonard Riggio, the company's founder and largest shareholder, said he sold 3.7 million shares on Thursday at $17.30 each.

Investors followed suit and the company's shares fell by 12.5% to close at $16.26 per share on the US markets.

Mr Riggio said he does not plan to sell more shares this year. In December 2013, he sold 2 million shares.

Even with the latest offload, Leonard Riggio remains the largest shareholder at Barnes & Noble.

In a statement, he said the latest sale "is part of his long-term financial and estate planning."

Barnes & Noble operates about 700 stores across 50 states in the US.

As with other brick-and-mortar booksellers, the company has been struggling with competition from online rivals and e-book sellers such as Amazon.

The Borders Group was at one time the second-largest bookstore chain in the US. It too struggled with competition from customers who switched to placing orders for print books online, instead of browsing at the stores.

Borders filed for Chapter 11 bankruptcy protection in 2011, burdened by too much debt.

- Published8 January 2014

- Published24 September 2013